Getting The Broker Mortgage Fees To Work

Wiki Article

Broker Mortgage Meaning Fundamentals Explained

Table of ContentsGet This Report on Mortgage Broker AssociationNot known Details About Broker Mortgage Rates Not known Details About Mortgage Broker Association A Biased View of Mortgage Broker AssistantLittle Known Facts About Mortgage Broker Association.Our Mortgage Broker Salary Ideas

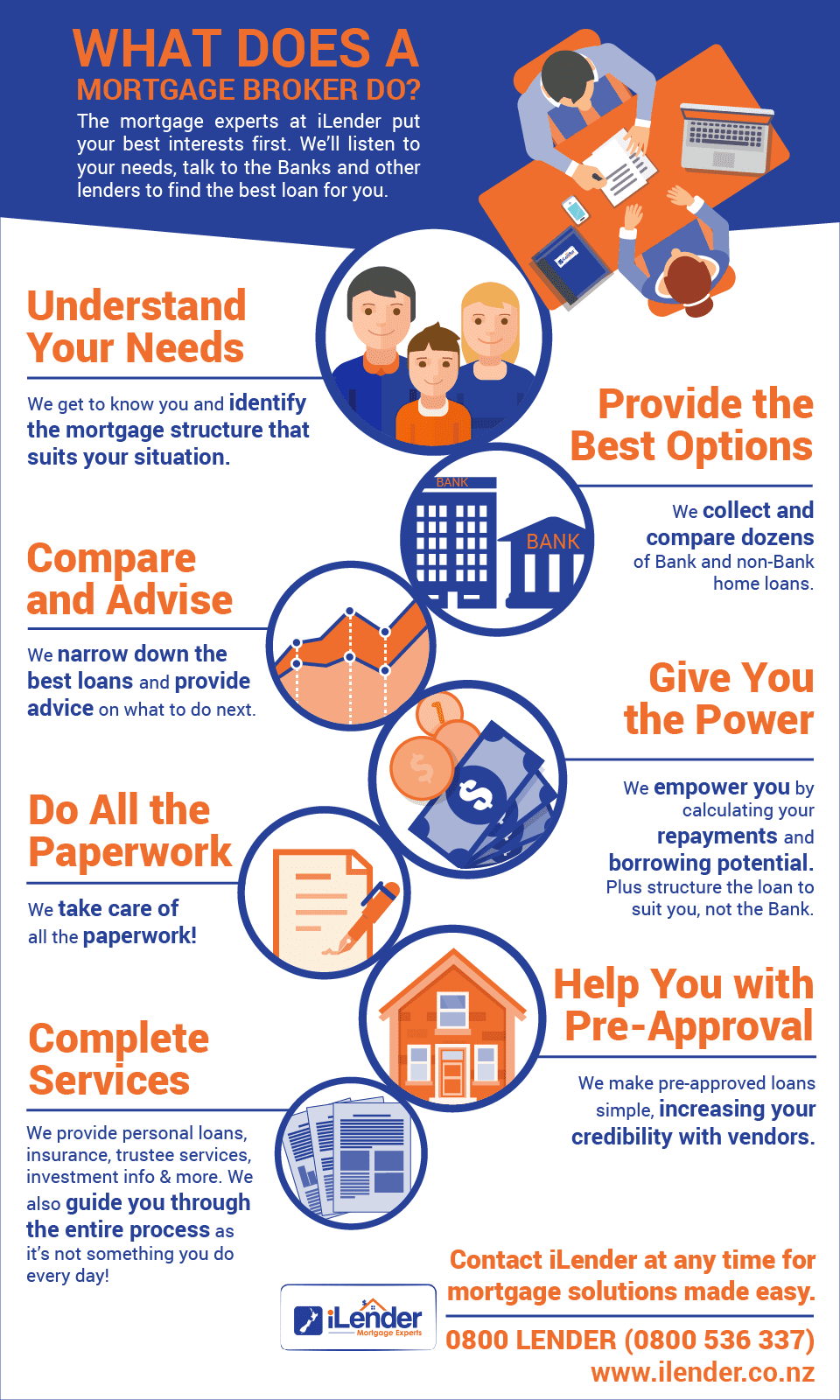

"What do I do currently?" you ask. This first meeting is basically an 'details gathering' goal. The home loan broker's work is to recognize what you're trying to achieve, exercise whether you prepare to enter every now and then match a lender to that. Before speaking about lenders, they need to gather all the info from you that a financial institution will require.

A major modification to the market happening this year is that Home mortgage Brokers will have to follow "Best Rate of interests Task" which implies that legitimately they have to place the client. Interestingly, the financial institutions do not have to adhere to this new guideline which will certainly profit those clients using a Mortgage Broker much more.

What Does Mortgage Broker Association Do?

It's a home mortgage broker's work to aid get you all set. It might be that your cost savings aren't quite yet where they should be, or it can be that your revenue is a little bit suspicious or you've been independent and also the financial institutions need more time to assess your situation. If you're not yet ready, a mortgage broker exists to equip you with the knowledge and also advice on just how to enhance your position for a loan.

The home is your own. Composed in collaboration with Madeleine Mc, Donald - broker mortgage calculator.

Mortgage Broker Vs Loan Officer Fundamentals Explained

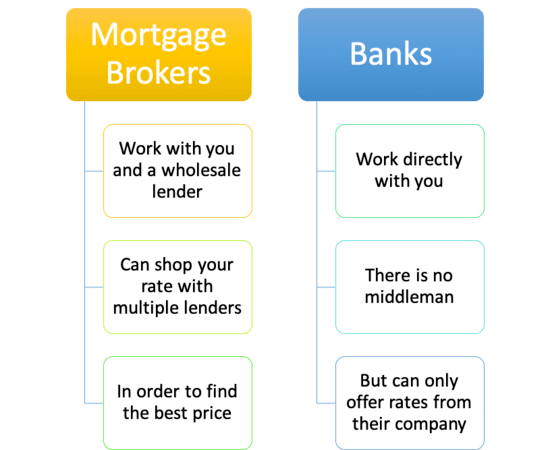

They do this by contrasting home loan products provided by a variety of lenders. A mortgage broker serves as the quarterback for your funding, passing the ball in between you, the customer, as well as the lender. To be clear, home mortgage brokers do a lot even more than aid you get a straightforward home mortgage on your residence.When you most likely to the financial institution, the bank can only supply you the items and services it has offered. A financial institution isn't most likely to tell you to drop the street to its competitor that supplies a mortgage product much better matched to your needs. Unlike a bank, a home loan broker commonly has connections with (sometimes some lenders that don't straight manage the general public), making his chances that far better of locating a lender with the very best home mortgage for you.

If you're looking to re-finance, access equity, or acquire a bank loan, they will certainly require details concerning your current fundings already in position. As soon as your home loan broker has an excellent idea about what you're looking for, he can focus on the. In most cases, your mortgage broker might have nearly whatever he needs to wage a home mortgage application at this moment.

The Buzz on Mortgage Broker

If you've already made a deal on a residential or commercial property and it's been approved, your broker will send your application as a real-time offer. Once the broker has a mortgage commitment back from the lender, he'll look at any kind of problems that need to be met (an assessment, evidence of income, evidence his response of deposit, and so on).This, in a nutshell, is just how a mortgage application functions. Why utilize a mortgage broker You may be asking yourself why you should utilize a home loan broker.

Your broker needs to be well-versed in the home loan products of all these lending institutions. This suggests you're most likely to find the finest home mortgage item that fits your requirements. If you're a private with damaged credit or you're acquiring a home that remains in less than outstanding condition, this is where a broker can be worth their weight in gold.

Broker Mortgage Rates Things To Know Before You Buy

When you go shopping on your own for a home mortgage, you'll require to look for a home loan at each loan provider. A broker, on the various other hand, must understand the loan providers like the rear of their hand and also must have the ability to hone in on the lending institution that's ideal for you, conserving you time as well as shielding your credit report from being reduced by using at also numerous loan providers.Be certain to ask your broker just how several lending institutions he handles, as some brokers have access to more lending institutions than others and might do a higher quantity of service than others, which suggests you'll likely get a much better price. This go to my site was a review of dealing with a home mortgage broker.

85%Marketed Rate (p. a.)2. 21%Comparison Rate (p. a.) Base standards of: a $400,000 funding amount, variable, repaired, principal and rate of interest (P&I) home mortgage with an LVR (loan-to-value) ratio of at the very least 80%. The 'Contrast Residence Loans' table permits for estimations to made on variables as selected as well as input by the individual.

Broker Mortgage Fees - Truths

The alternative to making use of go to this site a home mortgage broker is for individuals to do it themselves, which is often referred to as going 'direct'. A 2018 ASIC study of consumers who had actually gotten a financing in the previous 12 months reported that 56% went straight with a lending institution while 44% underwent a home loan broker.Report this wiki page